The Tax-Free 401k Alternative

A 401k or IRA might be the worst way to save for retirement. Three Wealth killing elements of a 401k or IRA:

- Market Losses

- Taxes

- Wall Street hidden fees, commissions and expenses

Strangle your retirement, dragging your 401k returns down.

Market losses are forever and they compound just like gains. The money lost in the market is no longer working for you. Like spilt milk, it will never ever work for you again.

In 2008 Mutual Funds were cut in half. The S&P 500 index and the NASDAQ index were down about 40%. Your remaining funds have to do double duty just to get even.

- At 6.0% it will take 12 years to get even.

- At 7.2% 10 years

- At 8.0% 9 years

- At 9.0% 8 years

Retirement Plans are heavily taxed. The IRS can take up to 40% of each withdrawal while you are alive and up to 40% of each withdrawal made by your heirs.

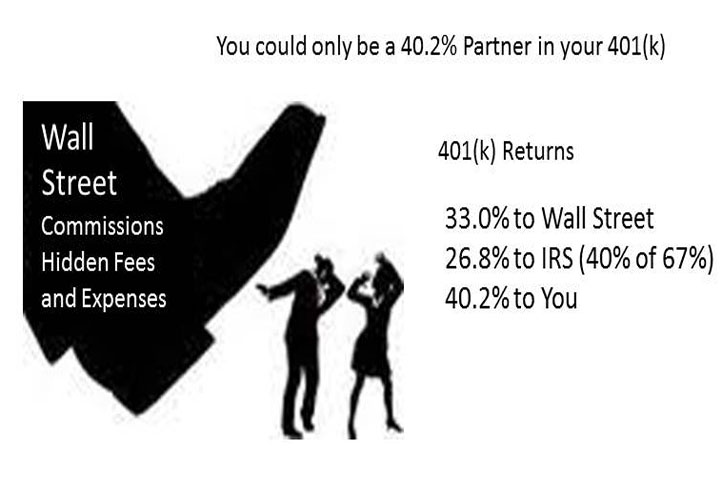

Wall Street hidden fees, commissions and expenses can reduce your 401k balance by 33% or more over 30 years. This could cost you hundreds of thousands of dollars making the 401k and expensive way to save for retirement.

Between Taxes and Wall Street Fees you may only be a 40.2% partner in your 401(k).

There is a solution. As the Honorable Appellate Court Justice once said, there are two systems of taxation in our country, one for the informed and one for the uninformed.

The uninformed choose 401ks and IRAs.

The informed choose an IRS approved Tax-Free 401k Alternative.

The Tax-Free 401k alternative has been called the perfect retirement solution. It has been used by the wealthiest American Families for more than 20 years to cut taxes and preserve capital.

It eliminates the 3 Wealth Killers dragging down 401(k) returns: Market Losses, Taxes and Wall Street hidden fees, commissions and expenses.

It has been called the perfect solution because:

- You don’t lose money when the markets go down, so you are never digging out of an investment hole.

- You share in market upside when the markets go up, subject to an annual market cap rate, currently 13% to 16%.

- You’ll earn a reasonable rate of return.

- Gains are locked in annually, so you never give back profits previously earned.

- Withdrawals are tax-free penalty free at any age for any reason.

Call 800-955-7898 for a free illustration

More videos at Taxfree.guru, retirement-toolbox.com and tax-free-income.com