Market Risk

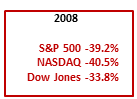

Market losses are forever. Losses compound just like gains. Money lost in the market is like spilt milk, lost forever and no longer working for you. Ever!

If your mutual funds are cut in half, your remaining money has to double just to get even.

- At 10% growth rate, that will take 7.2 years.

- At 8% growth rate, that will take 9 years.

- At 6% growth rate, that will take 12 years.

Still the money lost will never work for you again.

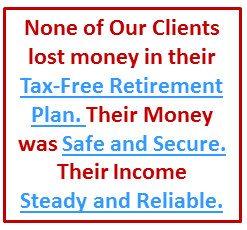

The Perfect Retirement Solution Eliminates Stock Market Losses.

- You don’t lose money when the markets go down, so you are never digging out of an investment hole.

- You share in market upside, subject to an annual cap rate, currently 13% to 16%, depending on the index chosen.

- Your gains are locked in annually, so you never give back profits previously earned.

- Your withdrawals are tax-free penalty free at any time, any age for any reason.

- You decide when and how much to withdraw, not the Federal Government. There are no RMDs, or required minimum distributions.

- You decide how much to contribute, not the Federal Government. Want to contribute $100,000 or $1,000,000 or more per year, a plan can be set up.

- When it is time (you decide) to withdraw, a tax-free income stream can be set up.